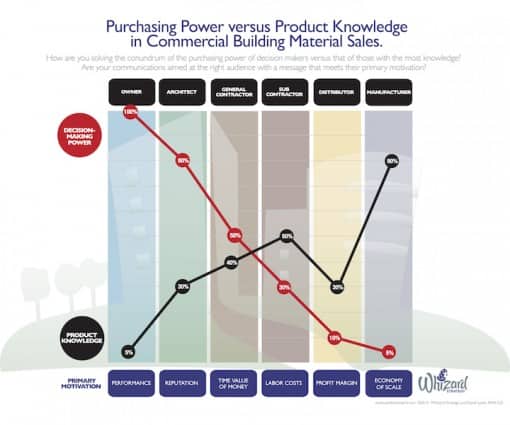

Your customer has the most power and the least knowledge while you have the most knowledge and the least power.

Let’s use this infographic to help explore how to help you improve the marketing and sales of your building material products.

This works whether your product is for the residential or commercial, new or retrofit markets.

Download a copy of the power and knowledge chart here.

While your product may differ from this example, it can still help you take a fresh look at where and how you should devote your resources for maximum success.

Let’s look across the top at the main individuals involved in the process of building a new commercial property.

First is the owner who decides to build the building in the first place.

The owner then usually selects an architect to design the building and specify the construction and product details.

Once the architect’s design is approved, the project is then turned over to the general contractor who selects the sub contractors.

Then there is usually a distributor involved in providing the actual product. Finally, there are the manufacturers of the products.

While there are often other audiences or influencers, such as installers, building inspectors, and unions, for this example let’s stick with these main players.

Now consider how much power each person has in the decision to use a specific product or brand.

We’re making some generalizations here, but for the sake of this exercise, let’s assume this is largely the norm.

The owner has all of the power to decide on a product. If the owner insists on a marble foyer, he will most likely get a marble foyer.

If he wants those cool Dyson hand dryers, you will probably find them in every restroom in the building.

The architect typically has about 80 percent power to decide what products will end up in the building.

In our opinion, the subcontractor has even less power, especially today. He is less likely to try to switch the product for two reasons.

First, he is nervous that he won’t be chosen to complete the work and the last thing he wants to do is rock the boat.

The second reason is his fear of liability. If he is successful in switching a product and there is a problem, he can be much more at risk.

The distributor has very little power to decide or influence what products get used in a new building.

They basically provide a service and fill orders. And the manufacturer has the least power of all.

There are a few brands that have the hefty marketing budgets required to influence a product decision.

These are usually more of an aesthetic or statement product, of which there are few.

Most manufacturers offer just one of the thousands of products that the owner or even the architect couldn’t care less about.

A manufacturer with an aggressive sales and marketing program can certainly lift themselves above 5 percent in decision-making power by using marketing to influence the preference for their products.

Now comes the irony, or the conundrum, when you look at the product knowledge graph and compare it to the power graph.

It’s amazing to see the vast disparity that often exists between the owner’s power to choose and his lack of product knowledge.

Next, we give the architect 50 percent for knowledge, primarily because they have so many products to consider and there are so many product advances, which they can’t be experts in all of them.

The general contractor, like the architect, must have a working knowledge of many products, so they often don’t have a high level of knowledge of most products.

The subcontractor should have a much higher level of knowledge within their specialty, but we only rate them at 50 percent.

This is because of their habit of not following manufacturers’ installation instructions and for their resistance to try new products, which may be better for the building owner.

We gave the distributor only 30 percent product knowledge because product knowledge is not their core competency.

Their job is to get you the products you want when you want them.

Finally, we gave manufacturers 80 percent for product knowledge. We didn’t give them 100 percent because they can’t know everything about their competitors’ products.

The next step is to consider the primary motivation of each audience listed across the bottom of this infographic.

We have assigned a primary motivation for each audience, and just like the power and knowledge percentages, feel free to change them for your particular situation.

The owner’s primary motivation is that the building performs as he intended.

It may perform as an investment, community statement or a long-lasting, low-maintenance facility.

The architect is concerned primarily about his reputation. His next projects largely come from previous buildings.

The general contractor is concerned mostly about the time value of money. The longer it takes to complete a building, the less profit he makes.

The subcontractor’s primary motivation is the cost of labor, which is one of the only things he can control.

If he perceives that his labor will have any trouble installing your product, he will resist using it.

The distributor is focused on his profit margin. Does your product have demand in place?

Don’t count on the distributor to create demand that’s your job.

The manufacturer’s motivation is economy of scale, which is how he can most easily increase his margin.

Now step back and think about your situation. Ask yourself if you are focusing on the right audience with the right messages?

Are there any steps you could take to shift the balance of power and knowledge to your advantage?

Subscribe To My Newsletter

If you like what I say, sign up for my newsletter here and get my weekly newsletter every Sunday night.

“This graphic is as powerful today as the day we developed it for your book! Keep spreading the word!”

David Leslie, RWC

Director of Technical Services & Product Management

Polyguard Products, Inc.